A rebalance date is an important aspect of an investment strategy because it is the date that triggers adjustments to bring a portfolio back in line with its desired asset allocation. It does this by adjusting buying and selling assets to meet the target risk and return. The Bmay Rebalance Date for specific strategies, e.g. indexes, or sector-specific funds (or diversified-portfolio) probably translates to a rebalance event happening in May (presumably on the same day every year). So here are a few reasons why this date is so significant.

1.Portfolio Realignment

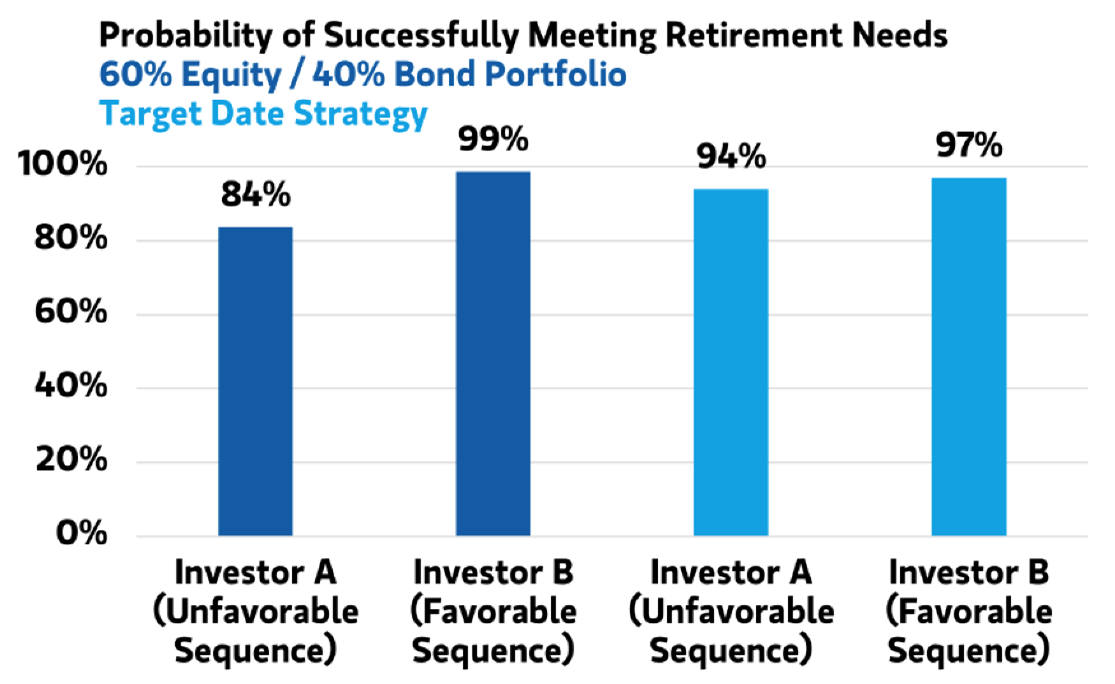

The Bmay Rebalance Date means the portfolio manager can buy or sell funds to bring them back into alignment with the original plan. As markets move over time, some assets may drift slightly to be above or below the target allocation. For example, a 60/40 portfolio may shift towards being 70% stocks if equities outperform bonds. The rebalancing is done on this date to bring the portfolio back into balance.

2. Risk Management

Rebalancing is all about risk management. Various assets have different risks. When riskier assets expand ahead of more conservative ones, it can lead to a higher level of price shock emanating from the portfolio. Rebalancing on a certain date protects the investor from having too high of exposure to assets with high risk, and sets the portfolio at its desired risk level.

3. Enhancing Returns

Strategic rebalancing can increase long-term returns by implementing an orderly buy-low, sell-high system. In case of asset rebalancing, a manager will sell some valuable assets (though probably overvalued) and reach them to buy cheaper (although undervalued) underperforming assets. This disciplined effort is what allows us to capture value over market cycles.

4. Tax Considerations

As the funds adjust, rebalancing could create capital gains and losses that will generate tax consequences. This way investors can plan either for the worst case scenario of potential tax liability or to use a strategy like tax-loss harvesting in their favor knowing that there will be a rebalance on specific date (Bmay).

5. Market Conditions and Timing

When these strategies decide to rebalance may also be associated with market dynamics. Rebalancing around May (strongly volatile month may be due to earnings or macroeconomic releases) may exploit market state. It also helps in keeping the portfolio from going astray during turbulent times in markets.

6. Consistency and Discipline

A set rebalance date at Bmay helps to instil discipline in the investment process. It saves on emotion led trading based on market noise. Rebalancing the portfolio on a regular schedule ensures that it stays true to the long-term investment plan and is not swayed by short-term market movements.

7. Impact on Index Funds and ETFs

The rebalance date is an important notion for index funds and ETFs, particularly those that track sector or country-specific indexes. If an index is given a weight of 10%, and in May, or whenever the re-balancing occurs, that fund must now make sure it holds 10% this XYZ company. If it fails to rebalance on time, tracking errors could arise causing the fund’s performance to significantly differ from that of its benchmark.

Conclusion

The Bmay Rebalance Date We went into greater detail on the mechanics of how a portfolio stays aligned with its strategy due to the workings of this date. For risk management, return optimization, tax efficiency or tracking stock market indices directly regular cycles when portfolios are rebuilt into their true form ensures that the ideal portfolio structure is restored at appropriate intervals to achieve long-term preferences. Investors can thus appreciate the timing and purpose behind any rebalancing.